Everything You Need to Know About VA Loans

Unlike conventional loans, VA loans are guaranteed by the VA but issued through private lenders. This guarantee reduces risk for lenders, enabling them to offer favorable terms such as no down payment and lower interest rates.

Who Is Eligible for a VA Loan?

To qualify for a VA loan, you must meet at least one of the following criteria:

- Active-Duty Service Members: Typically eligible after 90 days of continuous service during wartime or 181 days during peacetime.

- Veterans: Must meet minimum service requirements based on your period of service.

- National Guard and Reservists: Generally eligible after six years of service or 90 days of active duty.

- Spouses of Service Members: Surviving spouses of service members who died in the line of duty or as a result of a service-connected disability may also qualify.

You’ll need a Certificate of Eligibility (COE) to verify your eligibility. You can obtain this through your lender, the VA, or eBenefits online.

Benefits of VA Loans

No Down Payment

Unlike conventional loans requiring a down payment of up to 20%, VA loans allow borrowers to secure financing without upfront costs.

Competitive Interest Rates

VA loans offer lower interest rates than conventional or FHA loans, saving borrowers thousands over the life of the loan.

No Private Mortgage Insurance (PMI)

With VA loans, there's no need for PMI, reducing monthly costs and making homeownership more affordable.

How to Apply for a VA Loan

Step-by-Step Application Process

✔ Obtain Your Certificate of Eligibility (COE): This can be done online through the VA portal, via mail, or by asking your lender to assist.

✔ Assess Your Credit and Finances: While VA loans have no strict credit score minimum, a score of 620 or higher is often preferred by lenders.

✔ Choose a VA-Approved Lender: Select a lender experienced in VA loans to guide you through the process.

✔ Get Preapproved: Submit your financial details, including income and debts, to determine how much you can afford.

Find a Home: Work with a real estate agent to find a property meeting VA loan requirements.

✔ Complete the Appraisal and Underwriting: The VA will conduct a home appraisal to ensure it meets minimum property standards.

✔ Close on Your Loan: Finalize the process by signing the necessary paperwork and receiving your keys.

Choosing a Lender

Not all lenders specialize in VA loans. Research options, compare rates, and select one with expertise in VA loan processing.

Preapproval Tips

Prepare your financial documents, including pay stubs, tax returns, and bank statements, to expedite the preapproval process.

Costs Associated with VA Loans

VA Loan Funding Fee

The funding fee supports the VA program and varies depending on your down payment and whether it’s your first VA loan. For first-time borrowers with no down payment, the fee is 2.3% of the loan amount.

Closing Costs

VA loans reduce many traditional fees, but borrowers are still responsible for costs like title fees, taxes, and homeowner’s insurance.

Common Hidden Expenses

Be prepared for costs like home inspections, pest inspections (often required by the VA), and maintenance expenses for your new home.

Common Misconceptions About VA Loans

You Can Only Use It Once

False! You can use your VA loan benefit multiple times as long as you pay off the previous loan or restore your entitlement.

VA Loans Take Longer to Close

While VA loans have additional steps like the appraisal, they often close in the same timeframe as conventional loans.

VA Loans Are Only for First-Time Buyers

VA loans can be used by repeat buyers and are available for refinancing, too.

Tips for Using Your VA Loan

⭐ Work with an Experienced Realtor: Choose an agent who understands VA loan requirements to avoid surprises during the homebuying process.

⭐ Know Your Budget: Just because you qualify for a certain amount doesn’t mean you should max it out. Consider your long-term financial goals.

⭐ Understand VA Funding Fees: While VA loans don’t require PMI, there is a one-time funding fee, which can often be rolled into the loan amount.

Why a VA Loan Is Perfect for Military Buyers in San Antonio?

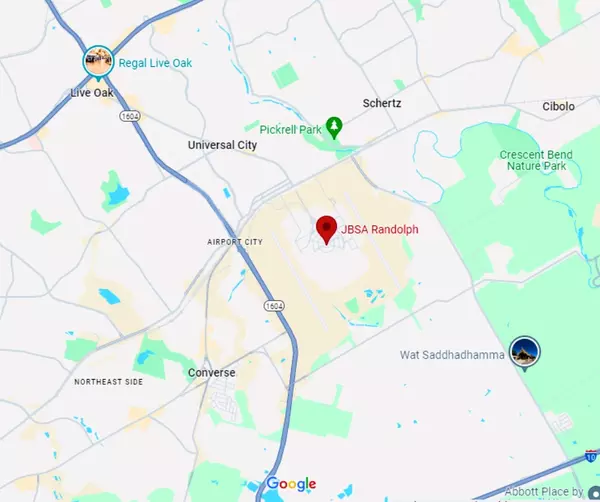

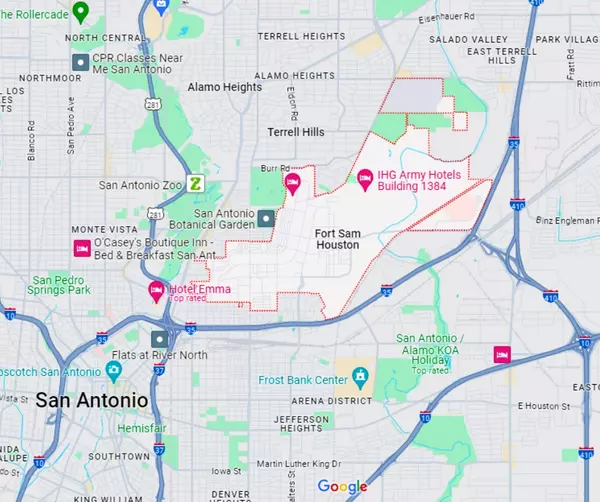

San Antonio, with its strong military presence, affordable housing market, and proximity to military installations like Joint Base San Antonio, is an ideal city for using your VA loan benefits. The area's diverse neighborhoods, excellent schools, and family-friendly atmosphere make it a top choice for military families looking to settle down.

VA loans are a powerful tool to help military families achieve the dream of homeownership. With no down payment, lower interest rates, and flexible requirements, they’re a smart choice for veterans and active-duty service members. If you’re ready to take the next step in your homebuying journey, reach out to a VA-approved lender and start exploring your options today.

See this special episode about VA Loan Assumption: San Antonio SECRETS to saving BIG on your next Home Purchase

Are you a veteran looking to buy or sell in San Antonio, Texas?

Let me help! As a fellow veteran and military-focused Realtor, I specialize in guiding veterans and active-duty service members through the homebuying process. Contact me today to get started!

Categories

Recent Posts