Navigating Home Financing in San Antonio | A Comprehensive Guide for Buyers

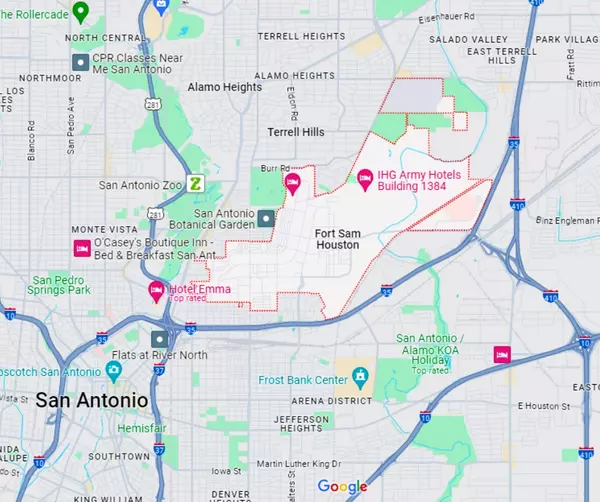

Welcoming You to San Antonio's Real Estate Landscape! San Antonio, famous for its Alamo and vibrant River Walk, is more than just a hub for history buffs and foodies—it's also a blossoming field for prospective home buyers. Boasting an eclectic mix of modern condos and charming single-family homes, San Antonio's real estate market is as diverse as the city itself. Now, buying a home is a significant step, and just like you wouldn't waltz into the Alamo without first knowing its history, you shouldn't step into the home-buying process without understanding the role of financing. Whether you're buying your first home or upgrading to a more spacious abode, navigating the financial landscape is crucial. From mortgages to interest rates, your financing decisions can make all the difference in securing your dream home. This article aims to be your financial compass, guiding you through the various financing options and helping you understand how they could affect your home-buying journey in San Antonio. Buckle up; let's dive in! The Current State of Home Financing First, let's set the scene. San Antonio's real estate market has been on a steady climb. With its rich culture, booming job market, and affordable cost of living, more and more people are finding the city an attractive place to call home. As the demand rises, so does the importance of understanding how to finance a home. You see, buying a home isn't as simple as swiping a credit card. It involves mortgages, interest rates, and down payments—factors that could influence your ability to secure your dream home. Luckily, there's an array of financing options available to you. You've got your traditional mortgages, government-backed loans, and even programs specifically designed for first-time buyers (Texas Department of Housing and Community Affairs). The trick is figuring out which path aligns with your financial situation and long-term goals. And that, dear reader, is exactly what we'll explore in the coming sections of this article. Stay tuned! Understanding Your Financing Options When it comes to financing your home in San Antonio, there's no one-size-fits-all solution. Some homebuyers might lean towards traditional loans while others might benefit more from FHA or VA loans, especially if they're first-time homebuyers or veterans, respectively. Traditional mortgages usually require a significant down payment, typically around 20% of the home's purchase price. But don't sweat it if you don't have that amount saved up. Programs like the FHA (Federal Housing Administration) loan require a much smaller down payment, typically around 3.5% (source). If you're a veteran or active-duty military member, the VA (Veterans Affairs) loan program might be worth looking into. The cherry on top? VA loans typically require no down payment at all (VA Loans). The bottom line? Knowing your options is key. And, in our next section, we'll guide you on how to navigate these financing routes. Don't miss it! Choosing the Right Mortgage Lender Choosing the right mortgage lender is another key step in the home-buying process. It's essential to shop around, compare rates, and consider customer service. Bankrate is an excellent resource for comparing mortgage lenders, as it offers reviews and information about different lenders, their offerings, and current rates. In San Antonio, there are many local and national lenders to choose from. Some popular ones include Wells Fargo, USAA, and Security Service Federal Credit Union. These lenders offer a variety of loan options, catering to different buyer needs. Remember, the key is to choose a lender that offers favorable rates, has good customer service, and can cater to your specific needs. Wrapping Up Understanding the financing landscape is key to making informed decisions when buying a home in San Antonio. This guide provides you with a glimpse into what's available, but remember, the journey doesn't end here. Consulting with a financial advisor or mortgage specialist will offer more personalized guidance based on your financial situation. Happy house hunting, future San Antonio homeowners! The Importance of Pre-Approval Another key part of the financing process is securing pre-approval for your mortgage loan. It not only helps you understand how much house you can afford but also shows sellers that you're a serious buyer. Sites like Rocket Mortgage can help you through this process online, and local lenders will also provide this service. A pre-approval letter from your lender is a powerful tool in competitive markets like San Antonio. In fact, it's not uncommon for sellers to require a pre-approval letter with any offer to purchase their home. Credit Score and Home Buying Your credit score plays a significant role in your ability to secure a home loan and the interest rates you'll receive. It’s crucial to monitor your credit and understand your score before you begin the home-buying process. There are several credit bureaus like Experian, TransUnion, and Equifax that provide free annual credit reports. Remember, a higher credit score often leads to more favorable loan terms, so it's worth ensuring your credit is in the best shape possible before starting your house-hunting journey in San Antonio. Down Payment and Closing Costs It's essential to understand that buying a home involves more than just the monthly mortgage payment. Home buyers should also be prepared to pay for the down payment and closing costs, which can amount to significant sums. Typically, you'll need to save at least 3.5% to 20% of the home's purchase price for the down payment. First-time homebuyers might be eligible for programs like the FHA loans which offer lower down payment options. Closing costs, on the other hand, can include a range of fees such as lender fees, appraisal fees, title insurance, and more. These costs typically range from 2% to 5% of the loan amount. Exploring Various Loan Types San Antonio home buyers have a variety of loan types to consider. From conventional loans and FHA loans for first-time buyers, to VA loans for veterans and military members, there's an option for almost every buyer. Sites like Bankrate provide great resources for comparing loan types and terms. In conclusion, understanding the financing landscape is crucial when buying a home in San Antonio. From getting pre-approved, checking your credit score, saving for the down payment and closing costs, to exploring various loan options, each step is vital in making your dream home a reality. Understanding Interest Rates Another essential aspect of home-buying financing is understanding interest rates. These rates can significantly impact the total amount you'll pay for your home over the length of your loan. Websites like Zillow can be helpful to keep an eye on current mortgage interest rates. State and Local Assistance Programs Moreover, don't forget to look for state and local assistance programs. These programs can offer grants, low-interest loans, and other types of assistance that can make home-buying more affordable. Texas has several programs aimed at first-time home buyers and those with low to moderate incomes. Consider Getting Professional Help Lastly, consider enlisting the help of a financial advisor or a real estate agent experienced with the local market. They can help you navigate the complexities of home financing and help you make the best decision for your circumstances. In summary, understanding the financing landscape in San Antonio is a crucial part of the home-buying process. By familiarizing yourself with these concepts and resources, you'll be well-prepared to make an informed decision when purchasing your dream home. Happy house hunting! Exploring Mortgage Options We can't talk about financing without mentioning mortgage options. In San Antonio, a variety of mortgage types are available. From conventional mortgages to government-backed loans like FHA and VA loans, there is a mortgage out there that fits your financial situation. Look at the requirements, benefits, and drawbacks of each to understand which suits you best. Pre-approval Importance Moreover, getting pre-approved for a mortgage before you start house hunting is a good strategy. It gives you a clear idea of how much you can afford and shows sellers that you're serious about buying. Understanding Closing Costs It's also important to be aware of closing costs. These costs can add up to a significant amount and include things like loan origination fees, appraisal fees, and title insurance. Your lender will give you an estimate of these costs when you apply for a mortgage, so there are no surprises at closing. Conclusion Having a solid understanding of the financing landscape can greatly simplify the home-buying process and eliminate unnecessary stress. Taking the time to learn about and explore your options will ultimately lead you to make the best financial decisions. Remember, San Antonio is a vibrant city waiting for you to find your perfect home!

Title: "10 Tips for a Smooth Transition When Moving to San Antonio, TX"

Welcome to San Antonio, Y'all! So, you've decided to move to San Antonio, Texas - the land of the Alamo, tasty Tex-Mex, and the scenic River Walk. You're in for a real treat! This city has a ton to offer, from a rich cultural history to friendly locals and a thriving job market. But let's be honest, moving can be a real pain in the neck, right? The good news is, it doesn't have to be! With a bit of planning and organization, you can make your move to San Antonio a breeze. In this guide, we'll walk you through 10 tips for a smooth transition to your new Texas home. Yeehaw! 🤠 Do Your Homework: Find the Perfect Neighborhood Before you pack your bags, it's essential to find the right neighborhood in San Antonio. This city is diverse, with each area offering its own unique charm and amenities. Do you want a family-friendly neighborhood with top-notch schools? GreatSchools can help you find them. Are you a young professional looking for a hip, urban vibe? The Pearl District might be right up your alley. Spend some time researching the different neighborhoods and consider factors like safety, walkability, and proximity to your workplace. The more you know, the better prepared you'll be for your move. Plan, Plan, Plan: Create a Moving Checklist The organization is key to a stress-free move. Start by creating a moving checklist, which will help you stay on top of important tasks like hiring movers, packing, and updating your address. If you're not sure where to start, this checklist from MYMOVE has you covered. Be sure to establish a moving budget too, so you don't end up with any nasty financial surprises. 3. Pick Your Movers Wisely You're going to need some help with this move, so it's crucial to find a reputable moving company. Look for reviews on sites like Yelp and Better Business Bureau, and ask friends and family for recommendations. Make sure you get at least three quotes and compare prices, services, and any extra fees. Don't forget to double-check their licensing and insurance info, so you're protected in case something goes wrong. Out with the Old: Declutter Before You Pack Let's face it, we all have stuff we don't need. Moving is the perfect opportunity to declutter and downsize. Not only will this make packing easier, but it can also save you money on moving costs. Start by going through your belongings and deciding what to keep, donate, or toss. You can even make some extra cash by selling unwanted items on sites like eBay or Facebook Marketplace. Alert the Authorities: Update Your Address Okay, maybe not the authorities, but you'll need to notify important parties of your move. Start by updating your address with the United States Postal Service to ensure your mail gets forwarded to your new place. Then, inform your bank, insurance providers, and other essential contacts of your new address. Don't forget to set up utilities in San Antonio, like electricity and internet, before you arrive. Get Ready to Roll: Learn About San Antonio Transportation Whether you're driving or taking public transportation, it's essential to familiarize yourself with San Antonio's traffic patterns and transit options. The city's public transit system, VIA Metropolitan Transit, provides bus and paratransit services throughout the area. Check out their website for route information, schedules, and fares. If you plan on driving, be prepared for some traffic congestion during peak hours. Don't forget to get a Texas driver's license within 90 days of moving to San Antonio. You can find more information on the Texas Department of Public Safety website. Make New Friends: Get Involved in the Local Community Moving to a new city can be a bit intimidating, but getting involved in the local community can help you feel right at home. Attend local events, like the Texas Folklife Festival or Fiesta San Antonio, to meet new people and learn about the city's vibrant culture. You can also join clubs, organizations, or sports teams that interest you. Sites like Meetup can help you find local groups that share your hobbies and interests. Dress for Success: Prepare for San Antonio's Climate San Antonio has a humid subtropical climate, which means hot summers and mild winters. Be prepared for the heat by stocking up on lightweight, breathable clothing, sunscreen, and plenty of water bottles. Don't forget to invest in a good air conditioner for your new home! During the cooler months, you'll want to have some light layers on hand, as temperatures can drop in the evenings. Secure That Bag: Explore the Job Market and Local Economy If you haven't already lined up a job in San Antonio, it's time to start exploring the local job market. The city is home to a diverse range of industries, including healthcare, education, and technology. Websites like Indeed and Glassdoor can help you search for job opportunities in your field. Don't forget to update your resume and start networking with professionals in your industry. Embrace the Texan Way: Dive into San Antonio's Culture and Attractions One of the best ways to feel at home in a new city is to immerse yourself in its culture and attractions. San Antonio has a rich history and a thriving arts scene, so there's no shortage of things to see and do. Explore the San Antonio Missions National Historical Park, visit the iconic Alamo, or take a leisurely stroll along the River Walk. And of course, be sure to indulge in some delicious Tex-Mex cuisine at local favorites like Mi Tierra Café y Panadería or Rosario's. There you have it! Follow these 10 tips, and you'll be well on your way to a smooth transition in your new San Antonio home. Now, saddle up and get ready to embrace that Texan lifestyle. Good luck, and happy moving! 🚚 You can check more listing and Blogs about San Antonio on this Website https://www.sharprealtygrouptx.com/

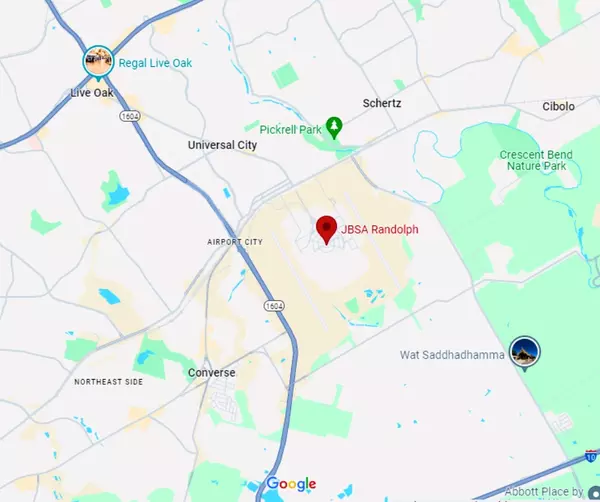

Schertz Economic Development

Schertz Economic Development is an organization dedicated to promoting business growth and economic development in the city of Schertz. They work with businesses, entrepreneurs, and developers to create opportunities for job creation, investment, and community development. Their focus is on attracting and retaining businesses in Schertz, and they offer a range of programs and services to support this goal. Some of the programs and services offered by Schertz Economic Development include site selection assistance, business financing programs, workforce training and development, and marketing and promotional support. They also work closely with the Schertz Chamber of Commerce and other local organizations to support the business community and promote economic growth. Schertz Economic Development has been successful in attracting a range of businesses to the city, including manufacturing, distribution, and technology companies. This has resulted in a diverse and growing economy, with a range of employment opportunities for residents of Schertz and surrounding areas. Overall, Schertz Economic Development plays an important role in the economic vitality of the city, and their efforts have helped to create a thriving business community that benefits residents and businesses alike.

Categories

Recent Posts