New Construction vs Pre-Owned Homes? Which will fit your needs the most

New construction and pre-owned homes both have their own advantages and disadvantages. Here are some pros and cons of each option: Pros of new construction: Customization: One of the biggest advantages of new construction is that you have the ability to customize your home according to your needs and preferences. You can choose your own floor plan, finishes, and features, making your home truly your own. Energy Efficiency: New homes are often built with the latest energy-efficient technology, such as Energy Star-rated appliances, high-efficiency HVAC systems, and insulation. This can result in lower utility bills and a more environmentally friendly home. Warranty: New construction homes often come with warranties that cover defects and repairs for the first few years, giving you peace of mind. Cons of new construction: Cost: New construction homes can be more expensive than pre-owned homes, particularly in desirable locations. Delays: Building a new home can be a lengthy process, and there may be delays due to weather, construction issues, or permit delays. Lack of Character: New construction homes can lack the charm and character of older homes. Pros of pre-owned homes: Lower cost: Pre-owned homes are generally less expensive than new construction homes, particularly if they need some updating or repairs. Established Neighborhoods: Pre-owned homes are often located in established neighborhoods with mature trees and landscaping, and may have amenities such as community pools, parks, and trails. Unique character: Older homes often have unique architectural features and charming details that cannot be found in new construction homes. Cons of pre-owned homes: Maintenance: Older homes may require more maintenance and repairs than new construction homes, which can be costly and time-consuming. Energy Efficiency: Pre-owned homes may not have the latest energy-efficient technology, resulting in higher utility bills and a less environmentally friendly home. Limited Customization: Pre-owned homes may not have the same level of customization options as new construction homes, limiting your ability to create your dream home. Ultimately, the decision between new construction and pre-owned homes depends on your personal preferences, budget, and priorities. It's important to consider all the factors and weigh the pros and cons before making a decision.

Things to know when PCS'ing to San Antonio Texas

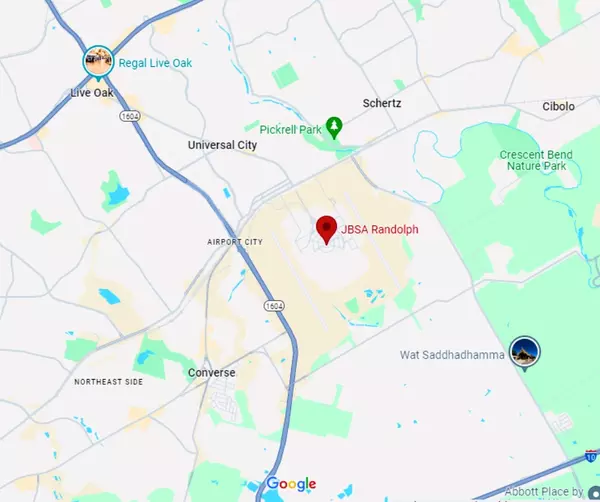

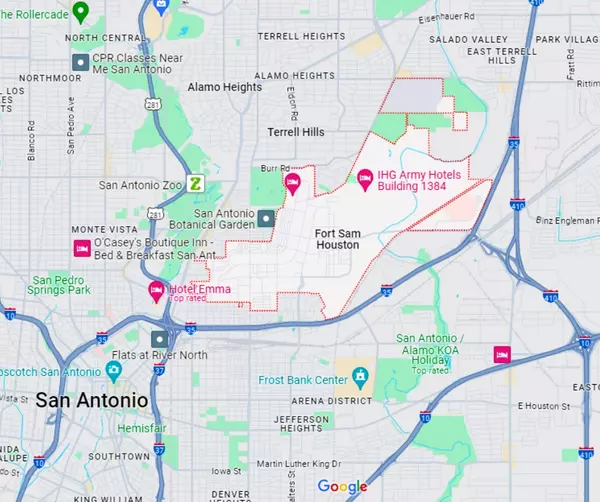

Military buyers moving to San Antonio have plenty of things to consider before settling down in this vibrant city. Here are some essential things to keep in mind: What military bases are located in San Antonio? San Antonio is home to several military bases, including Joint Base San Antonio (JBSA), which is made up of Lackland Air Force Base, Randolph Air Force Base, and Fort Sam Houston. What are the best neighborhoods for military families in San Antonio? Military families often prefer neighborhoods that are close to military bases, have good schools and provide easy access to shopping, dining, and entertainment. Some of the top neighborhoods for military families in San Antonio include Stone Oak, Alamo Heights, Boerne, Cibolo, Schertz, and New Braunfels What are the VA loan limits in San Antonio? The VA loan limit in San Antonio for 2021 is $548,250 for a single-family home. This amount may be higher in certain areas or for multi-unit properties. What are the closing costs associated with a VA loan in San Antonio? Closing costs for a VA loan in San Antonio can vary depending on several factors, including the property's purchase price, the lender, and the location. However, buyers using a VA loan can negotiate with the seller to pay for some or all of the closing costs. Are there any military discounts available for buying a home in San Antonio? San Antonio is a military-friendly city, and many businesses offer discounts to military members and their families. Some home builders and real estate agents also offer discounts to military buyers. Are there any special programs available for military home buyers in San Antonio? There are several programs available for military home buyers in San Antonio, including the VA Home Loan Program, which offers favorable terms for eligible military members, and the Texas Veterans Land Board, which offers land and home loans to Texas veterans and active military members.

Should you assume a VA Home Loan? Here are some things you should know first.

Assuming a VA home loan can be an excellent option for homebuyers who want to take advantage of the favorable terms of a VA loan. However, before assuming a VA home loan, it's essential to know several things that can help ensure a successful and satisfactory transaction. Confirm Eligibility Assuming a VA home loan requires meeting the VA's eligibility requirements, including being a veteran, active-duty service member, or surviving spouse of a veteran. The borrower must also meet the lender's underwriting criteria. Buyers should confirm their eligibility before proceeding to avoid any issues during the assumption process. Check if the Loan is Assumable Not all VA loans are assumable, so it's essential to confirm with the lender or the Department of Veterans Affairs whether the loan is assumable. If it's not assumable, the buyer will have to apply for a new loan to purchase the property. Review Interest Rate and Terms Buyers must review the existing loan's interest rate and terms before assuming a VA loan. The interest rate is typically fixed, and it may be lower than current market rates, making it a more affordable option. However, the interest rate is determined by the original loan terms, so buyers should determine whether the interest rate is reasonable and desirable. Review Loan Balance The loan balance of an assumed VA loan may be more or less than the purchase price of the home. Buyers should understand the remaining loan balance to ensure they can afford to make the payments. Review Loan Repayment Terms Buyers should review the terms of the existing VA loan they're assuming, including repayment terms, payment amounts, and whether there are any prepayment penalties. Understanding these terms is critical to ensuring a successful assumption and avoiding any surprises later. Fees and Closing Costs Fees and closing costs associated with assuming a VA loan may include appraisal fees, credit report fees, and title insurance, among others. Buyers should be aware of these costs and understand how they affect the total cost of assuming the loan. Inspect the Property Before assuming a VA loan, buyers should inspect the property to determine its condition. A professional inspection can identify any issues or necessary repairs and ensure the buyer is making a sound investment. In summary, assuming a VA home loan can be an excellent option for homebuyers, but there are several things buyers should know before proceeding. Confirming eligibility, checking whether the loan is assumable, reviewing interest rates and terms, understanding the loan balance and repayment terms, being aware of fees and closing costs, and inspecting the property are essential steps to ensure a successful and satisfactory transaction. By taking these steps, buyers can make an informed decision on whether assuming a VA home loan is the right option for them.

Categories

Recent Posts