DIY Delight: Step-by-Step Guides for Crafting Magic in San Antonio

San Antonio, Texas, with its rich cultural heritage and vibrant atmosphere, is a city that inspires creativity and innovation. One way to infuse your home and life with a touch of San Antonio's charm is by embarking on various do-it-yourself (DIY) projects. Whether you're looking to spruce up your living space with home renovations, give new life to old furniture through upcycling, or dive into the world of crafts, we've got you covered with step-by-step guides to unleash your inner DIY guru. 1. Home Renovations: Transforming Your Space San Antonio boasts a variety of home styles, from historic Spanish Colonial homes to modern abodes. If you're looking to revamp your space, here's a step-by-step guide to get you started: Inspiration: Begin by exploring San Antonio's architecture and design. Visit the historic districts like King William and Lavaca to gather ideas. Planning: Outline your project's scope, budget, and timeline. San Antonio's climate can be hot, so consider energy-efficient upgrades like installing reflective roofing materials or energy-efficient windows. DIY or Contractor: Decide whether to tackle the project yourself or hire a professional. Consult local directories or ask for recommendations from neighbors. Permits and Regulations: Check with the City of San Antonio for necessary permits and compliance with local building codes. Materials and Tools: Gather your materials and tools. Visit local stores like The Home Depot or Lowe's for supplies. Execution: Follow your project plan step-by-step, ensuring safety and quality. Don't forget to enjoy the process! 2. Furniture Upcycling: Adding Character to Your Home Upcycling furniture is a fantastic way to breathe new life into old pieces while adding a touch of San Antonio's eclectic style to your space. Here's how to do it: Scouting: Explore local thrift shops, antique stores, and flea markets like the First Monday Trade Days in San Antonio to find unique pieces. Design Vision: Envision how you want to transform the furniture. Perhaps a colorful Mexican Talavera tile mosaic table or a distressed Spanish Colonial dresser? Preparation: Clean, sand, and repair your furniture as needed. San Antonio's humidity can be harsh on wood, so make sure to protect your finished piece. Materials and Paint: Visit local craft stores such as Michaels or Jo-Ann Fabric for paint, brushes, and other supplies. Opt for colors and patterns that resonate with San Antonio's cultural flair. Technique: Learn techniques like distressing, decoupage, or stenciling to achieve your desired look. Finishing Touches: Add new hardware, such as rustic drawer pulls or decorative knobs, for an extra pop of style. 3. Crafts: Creating Handmade Treasures San Antonio's vibrant arts and crafts scene is an endless source of inspiration for DIY enthusiasts. Here's how to get started with crafting: Choose Your Craft: Decide on a craft that piques your interest. San Antonio has a thriving community of artisans, so you can find classes or workshops on various crafts like pottery, weaving, or painting. Gather Supplies: Visit local craft stores or markets like the San Antonio Arts and Crafts Market for high-quality materials. Learn the Basics: Start with the fundamentals. If you're into pottery, learn to shape clay; if it's painting, familiarize yourself with different techniques. Join a Community: San Antonio has numerous craft and art collectives. Join one to meet fellow artisans and gain inspiration from their work. Showcase Your Work: Consider participating in local craft fairs or art exhibitions to share your creations with the San Antonio community. San Antonio, Texas, is not just a place to enjoy its rich culture and history; it's also a place to infuse your surroundings with your own creativity and personality. With these step-by-step guides for DIY home renovations, furniture upcycling, and crafts, you can embark on exciting projects that reflect the vibrant spirit of San Antonio. So, roll up your sleeves, gather your materials, and start crafting your own slice of San Antonio heaven right at home. Happy DIY-ing!

San Antonio, Texas Real Estate: A Positive Outlook in the Heart of the Lone Star State

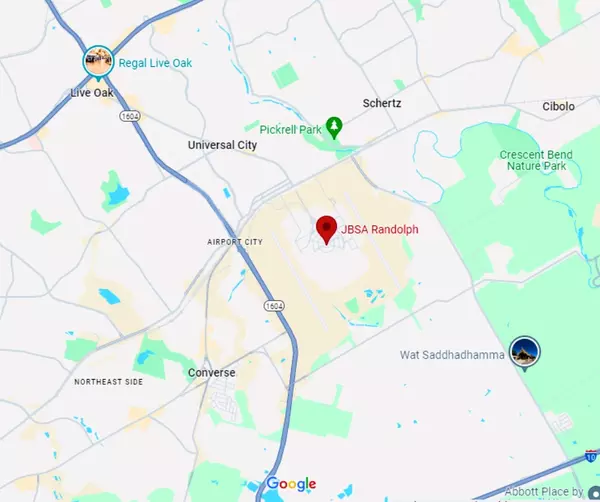

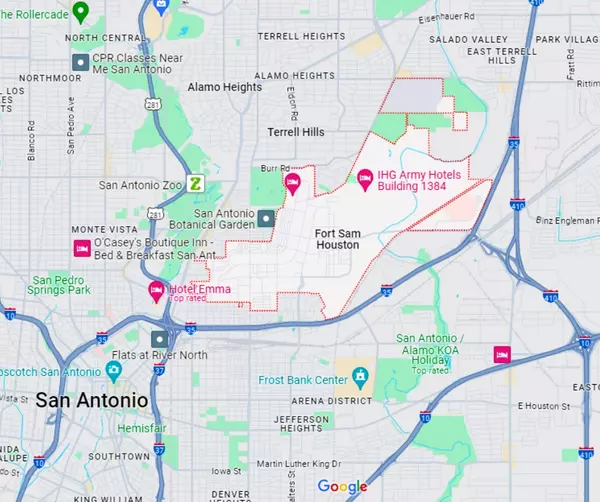

San Antonio, Texas, often referred to as the "Alamo City," is a vibrant and diverse metropolis nestled in the heart of the Lone Star State. With its rich history, booming economy, and unique blend of cultures, it's no wonder that the real estate market in San Antonio has been on a positive trajectory for years. In this blog post, we'll explore the key factors contributing to the robust real estate market in San Antonio, highlighting the opportunities and benefits for both buyers and investors. 1. Strong Economic Foundation One of the primary drivers of the San Antonio real estate market's strength is the city's robust and diversified economy. With a thriving job market, fueled by major employers like USAA, Valero Energy, and the healthcare industry, San Antonio has consistently low unemployment rates. As more people move to the area for employment opportunities, the demand for housing remains steady, making it an attractive market for real estate investors and homeowners alike. 2. Affordable Housing Options San Antonio boasts a relatively affordable housing market compared to many other major U.S. cities. This affordability attracts first-time homebuyers, families, and individuals looking for a more reasonable cost of living without sacrificing quality of life. From charming historic neighborhoods to modern developments, San Antonio offers a wide range of housing options to suit various budgets and preferences. 3. Thriving Cultural Scene San Antonio is a city rich in culture and history, offering residents and visitors an array of entertainment options. The famous River Walk, historical landmarks like the Alamo, and vibrant festivals year-round make the city an attractive destination. As a result, tourists and new residents continue to flock to San Antonio, contributing to the overall growth of the city and its real estate market. 4. Education and Research Hub Home to prestigious universities such as the University of Texas at San Antonio (UTSA) and a growing biomedical research community, San Antonio has become a hub for education and innovation. This has not only attracted a highly skilled workforce but has also fueled demand for housing near these institutions, presenting opportunities for real estate investors to capitalize on student and faculty housing. 5. Development and Infrastructure San Antonio's proactive approach to infrastructure development ensures that the city continues to thrive. Investments in transportation, public amenities, and urban planning have contributed to the city's quality of life. As new developments and communities spring up, the real estate market benefits from increased supply and diverse options for potential buyers and renters. 6. Strong Rental Market The rental market in San Antonio is also robust, making it an appealing option for real estate investors. The city's growing population, along with the presence of military bases like Lackland Air Force Base and Fort Sam Houston, has created consistent demand for rental properties. This dynamic rental market provides a steady stream of income for investors and property owners. San Antonio, Texas, offers a bright and promising outlook for anyone interested in the real estate market. With a strong economy, affordable housing options, a rich cultural scene, a thriving education sector, ongoing development, and a strong rental market, the Alamo City continues to attract homeowners and investors from all walks of life. Whether you're seeking a new place to call home or looking for an investment opportunity, San Antonio's real estate market is full of potential and positivity. As the city continues to grow and evolve, so too will its real estate opportunities. Don't miss out on the exciting possibilities that San Antonio has to offer in the world of real estate.

Navigating Home Financing in San Antonio | A Comprehensive Guide for Buyers

Welcoming You to San Antonio's Real Estate Landscape! San Antonio, famous for its Alamo and vibrant River Walk, is more than just a hub for history buffs and foodies—it's also a blossoming field for prospective home buyers. Boasting an eclectic mix of modern condos and charming single-family homes, San Antonio's real estate market is as diverse as the city itself. Now, buying a home is a significant step, and just like you wouldn't waltz into the Alamo without first knowing its history, you shouldn't step into the home-buying process without understanding the role of financing. Whether you're buying your first home or upgrading to a more spacious abode, navigating the financial landscape is crucial. From mortgages to interest rates, your financing decisions can make all the difference in securing your dream home. This article aims to be your financial compass, guiding you through the various financing options and helping you understand how they could affect your home-buying journey in San Antonio. Buckle up; let's dive in! The Current State of Home Financing First, let's set the scene. San Antonio's real estate market has been on a steady climb. With its rich culture, booming job market, and affordable cost of living, more and more people are finding the city an attractive place to call home. As the demand rises, so does the importance of understanding how to finance a home. You see, buying a home isn't as simple as swiping a credit card. It involves mortgages, interest rates, and down payments—factors that could influence your ability to secure your dream home. Luckily, there's an array of financing options available to you. You've got your traditional mortgages, government-backed loans, and even programs specifically designed for first-time buyers (Texas Department of Housing and Community Affairs). The trick is figuring out which path aligns with your financial situation and long-term goals. And that, dear reader, is exactly what we'll explore in the coming sections of this article. Stay tuned! Understanding Your Financing Options When it comes to financing your home in San Antonio, there's no one-size-fits-all solution. Some homebuyers might lean towards traditional loans while others might benefit more from FHA or VA loans, especially if they're first-time homebuyers or veterans, respectively. Traditional mortgages usually require a significant down payment, typically around 20% of the home's purchase price. But don't sweat it if you don't have that amount saved up. Programs like the FHA (Federal Housing Administration) loan require a much smaller down payment, typically around 3.5% (source). If you're a veteran or active-duty military member, the VA (Veterans Affairs) loan program might be worth looking into. The cherry on top? VA loans typically require no down payment at all (VA Loans). The bottom line? Knowing your options is key. And, in our next section, we'll guide you on how to navigate these financing routes. Don't miss it! Choosing the Right Mortgage Lender Choosing the right mortgage lender is another key step in the home-buying process. It's essential to shop around, compare rates, and consider customer service. Bankrate is an excellent resource for comparing mortgage lenders, as it offers reviews and information about different lenders, their offerings, and current rates. In San Antonio, there are many local and national lenders to choose from. Some popular ones include Wells Fargo, USAA, and Security Service Federal Credit Union. These lenders offer a variety of loan options, catering to different buyer needs. Remember, the key is to choose a lender that offers favorable rates, has good customer service, and can cater to your specific needs. Wrapping Up Understanding the financing landscape is key to making informed decisions when buying a home in San Antonio. This guide provides you with a glimpse into what's available, but remember, the journey doesn't end here. Consulting with a financial advisor or mortgage specialist will offer more personalized guidance based on your financial situation. Happy house hunting, future San Antonio homeowners! The Importance of Pre-Approval Another key part of the financing process is securing pre-approval for your mortgage loan. It not only helps you understand how much house you can afford but also shows sellers that you're a serious buyer. Sites like Rocket Mortgage can help you through this process online, and local lenders will also provide this service. A pre-approval letter from your lender is a powerful tool in competitive markets like San Antonio. In fact, it's not uncommon for sellers to require a pre-approval letter with any offer to purchase their home. Credit Score and Home Buying Your credit score plays a significant role in your ability to secure a home loan and the interest rates you'll receive. It’s crucial to monitor your credit and understand your score before you begin the home-buying process. There are several credit bureaus like Experian, TransUnion, and Equifax that provide free annual credit reports. Remember, a higher credit score often leads to more favorable loan terms, so it's worth ensuring your credit is in the best shape possible before starting your house-hunting journey in San Antonio. Down Payment and Closing Costs It's essential to understand that buying a home involves more than just the monthly mortgage payment. Home buyers should also be prepared to pay for the down payment and closing costs, which can amount to significant sums. Typically, you'll need to save at least 3.5% to 20% of the home's purchase price for the down payment. First-time homebuyers might be eligible for programs like the FHA loans which offer lower down payment options. Closing costs, on the other hand, can include a range of fees such as lender fees, appraisal fees, title insurance, and more. These costs typically range from 2% to 5% of the loan amount. Exploring Various Loan Types San Antonio home buyers have a variety of loan types to consider. From conventional loans and FHA loans for first-time buyers, to VA loans for veterans and military members, there's an option for almost every buyer. Sites like Bankrate provide great resources for comparing loan types and terms. In conclusion, understanding the financing landscape is crucial when buying a home in San Antonio. From getting pre-approved, checking your credit score, saving for the down payment and closing costs, to exploring various loan options, each step is vital in making your dream home a reality. Understanding Interest Rates Another essential aspect of home-buying financing is understanding interest rates. These rates can significantly impact the total amount you'll pay for your home over the length of your loan. Websites like Zillow can be helpful to keep an eye on current mortgage interest rates. State and Local Assistance Programs Moreover, don't forget to look for state and local assistance programs. These programs can offer grants, low-interest loans, and other types of assistance that can make home-buying more affordable. Texas has several programs aimed at first-time home buyers and those with low to moderate incomes. Consider Getting Professional Help Lastly, consider enlisting the help of a financial advisor or a real estate agent experienced with the local market. They can help you navigate the complexities of home financing and help you make the best decision for your circumstances. In summary, understanding the financing landscape in San Antonio is a crucial part of the home-buying process. By familiarizing yourself with these concepts and resources, you'll be well-prepared to make an informed decision when purchasing your dream home. Happy house hunting! Exploring Mortgage Options We can't talk about financing without mentioning mortgage options. In San Antonio, a variety of mortgage types are available. From conventional mortgages to government-backed loans like FHA and VA loans, there is a mortgage out there that fits your financial situation. Look at the requirements, benefits, and drawbacks of each to understand which suits you best. Pre-approval Importance Moreover, getting pre-approved for a mortgage before you start house hunting is a good strategy. It gives you a clear idea of how much you can afford and shows sellers that you're serious about buying. Understanding Closing Costs It's also important to be aware of closing costs. These costs can add up to a significant amount and include things like loan origination fees, appraisal fees, and title insurance. Your lender will give you an estimate of these costs when you apply for a mortgage, so there are no surprises at closing. Conclusion Having a solid understanding of the financing landscape can greatly simplify the home-buying process and eliminate unnecessary stress. Taking the time to learn about and explore your options will ultimately lead you to make the best financial decisions. Remember, San Antonio is a vibrant city waiting for you to find your perfect home!

Categories

Recent Posts