New Construction vs Pre-Owned Homes? Which will fit your needs the most

New construction and pre-owned homes both have their own advantages and disadvantages. Here are some pros and cons of each option: Pros of new construction: Customization: One of the biggest advantages of new construction is that you have the ability to customize your home according to your needs and preferences. You can choose your own floor plan, finishes, and features, making your home truly your own. Energy Efficiency: New homes are often built with the latest energy-efficient technology, such as Energy Star-rated appliances, high-efficiency HVAC systems, and insulation. This can result in lower utility bills and a more environmentally friendly home. Warranty: New construction homes often come with warranties that cover defects and repairs for the first few years, giving you peace of mind. Cons of new construction: Cost: New construction homes can be more expensive than pre-owned homes, particularly in desirable locations. Delays: Building a new home can be a lengthy process, and there may be delays due to weather, construction issues, or permit delays. Lack of Character: New construction homes can lack the charm and character of older homes. Pros of pre-owned homes: Lower cost: Pre-owned homes are generally less expensive than new construction homes, particularly if they need some updating or repairs. Established Neighborhoods: Pre-owned homes are often located in established neighborhoods with mature trees and landscaping, and may have amenities such as community pools, parks, and trails. Unique character: Older homes often have unique architectural features and charming details that cannot be found in new construction homes. Cons of pre-owned homes: Maintenance: Older homes may require more maintenance and repairs than new construction homes, which can be costly and time-consuming. Energy Efficiency: Pre-owned homes may not have the latest energy-efficient technology, resulting in higher utility bills and a less environmentally friendly home. Limited Customization: Pre-owned homes may not have the same level of customization options as new construction homes, limiting your ability to create your dream home. Ultimately, the decision between new construction and pre-owned homes depends on your personal preferences, budget, and priorities. It's important to consider all the factors and weigh the pros and cons before making a decision.

Should you assume a VA Home Loan? Here are some things you should know first.

Assuming a VA home loan can be an excellent option for homebuyers who want to take advantage of the favorable terms of a VA loan. However, before assuming a VA home loan, it's essential to know several things that can help ensure a successful and satisfactory transaction. Confirm Eligibility Assuming a VA home loan requires meeting the VA's eligibility requirements, including being a veteran, active-duty service member, or surviving spouse of a veteran. The borrower must also meet the lender's underwriting criteria. Buyers should confirm their eligibility before proceeding to avoid any issues during the assumption process. Check if the Loan is Assumable Not all VA loans are assumable, so it's essential to confirm with the lender or the Department of Veterans Affairs whether the loan is assumable. If it's not assumable, the buyer will have to apply for a new loan to purchase the property. Review Interest Rate and Terms Buyers must review the existing loan's interest rate and terms before assuming a VA loan. The interest rate is typically fixed, and it may be lower than current market rates, making it a more affordable option. However, the interest rate is determined by the original loan terms, so buyers should determine whether the interest rate is reasonable and desirable. Review Loan Balance The loan balance of an assumed VA loan may be more or less than the purchase price of the home. Buyers should understand the remaining loan balance to ensure they can afford to make the payments. Review Loan Repayment Terms Buyers should review the terms of the existing VA loan they're assuming, including repayment terms, payment amounts, and whether there are any prepayment penalties. Understanding these terms is critical to ensuring a successful assumption and avoiding any surprises later. Fees and Closing Costs Fees and closing costs associated with assuming a VA loan may include appraisal fees, credit report fees, and title insurance, among others. Buyers should be aware of these costs and understand how they affect the total cost of assuming the loan. Inspect the Property Before assuming a VA loan, buyers should inspect the property to determine its condition. A professional inspection can identify any issues or necessary repairs and ensure the buyer is making a sound investment. In summary, assuming a VA home loan can be an excellent option for homebuyers, but there are several things buyers should know before proceeding. Confirming eligibility, checking whether the loan is assumable, reviewing interest rates and terms, understanding the loan balance and repayment terms, being aware of fees and closing costs, and inspecting the property are essential steps to ensure a successful and satisfactory transaction. By taking these steps, buyers can make an informed decision on whether assuming a VA home loan is the right option for them.

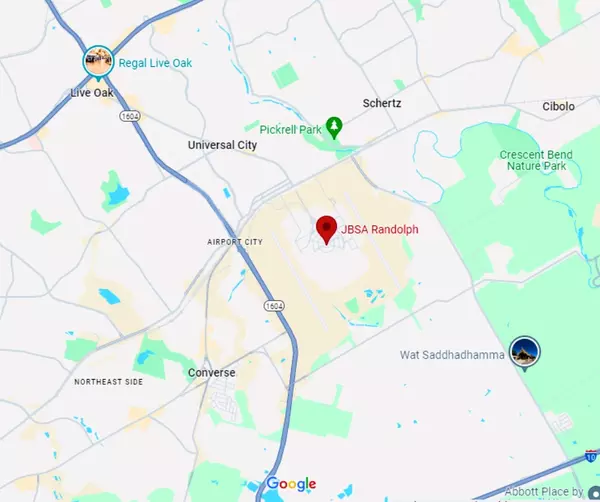

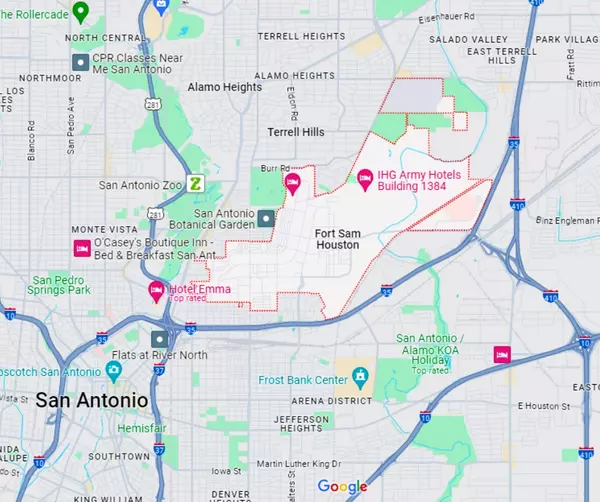

10 Reasons to Buy a Home in Schertz, Texas

If you are considering purchasing a home in Texas, the small city of Schertz may be worth a closer look. Located in the heart of the state, Schertz offers a high quality of life, excellent schools, and a vibrant community. Here are ten reasons why Schertz could be the perfect place for you to call home. Affordable Cost of Living: Schertz has a cost of living that is lower than the national average. With affordable housing options, as well as lower taxes and utility costs, Schertz can be an excellent place to settle down and enjoy a comfortable lifestyle. Strong Real Estate Market: The real estate market in Schertz is thriving, with a steady increase in property values over the years. With low unemployment rates, a strong economy, and a growing population, Schertz is an ideal place to invest in real estate. Family-Friendly Community: Schertz is a family-friendly city, with excellent schools, parks, and community events. The city is known for its safe streets, high-quality public services, and close-knit community that welcomes newcomers with open arms. Excellent Schools: The Schertz-Cibolo-Universal City Independent School District is highly rated and provides top-notch educational opportunities for students of all ages. The district is home to several award-winning schools and has a strong focus on student achievement. Access to Major Cities: Schertz is centrally located in Texas, providing easy access to major cities like San Antonio, Austin, and Houston. This makes it an ideal location for those who want to enjoy the amenities of a big city while still having a small-town feel. Vibrant Cultural Scene: Schertz is home to a diverse population, with a vibrant cultural scene that includes a variety of restaurants, shops, and events. The city is also located close to the famous River Walk in San Antonio, which offers a plethora of cultural and entertainment options. Outdoor Recreation: Schertz has an abundance of outdoor recreation opportunities, with several parks and trails to explore. The city also hosts numerous outdoor events throughout the year, including festivals, concerts, and farmers' markets. Growing Economy: Schertz has a robust and growing economy, with a range of industries including manufacturing, retail, healthcare, and education. The city is home to several major employers, including Randolph Air Force Base and Amazon. Quality Healthcare: Schertz residents have access to high-quality healthcare through several hospitals and medical centers in the surrounding area. The city is home to several healthcare providers, including Northeast Methodist Hospital and Schertz Medical Home. Friendly Community: Schertz is known for its friendly and welcoming community, with residents who are proud to call the city home. The city has a strong sense of community, with numerous volunteer opportunities and community events that bring residents together. In conclusion, Schertz, Texas is a great place to call home. With its affordable cost of living, strong real estate market, excellent schools, and vibrant community, Schertz offers something for everyone. Whether you are a young family, a retiree, or a real estate investor, Schertz is a city that is definitely worth considering.

Categories

Recent Posts